ASML Q4: NXE:3400C Machines Ramp; Strong Growth Due to EUV in 2020

Earlier today ASML held its fourth-quarter earnings call. Although the semiconductor equipment market experienced an 8-10% decline in 2019 mainly attributed to a weaker memory market, ASML saw a sales growth of 8%. As expected, this is largely thanks to EUV.

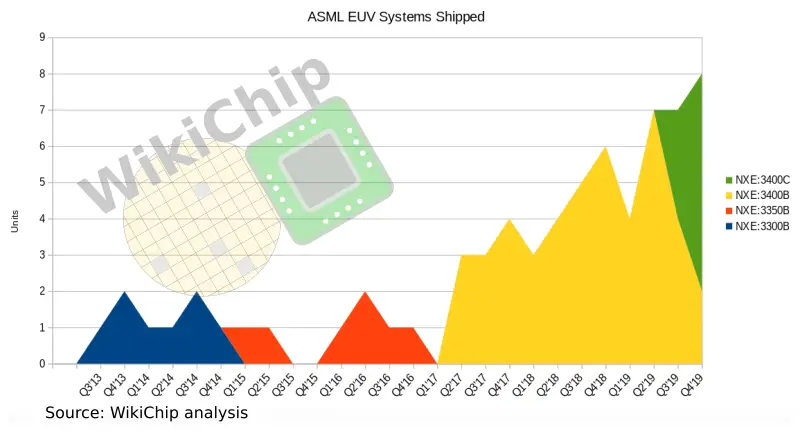

In 2019, ASML had a net sales of €11.8 billion with €8,996 billion in net systems sales which included 229 machines. 2019 was an inflection point for EUV. This was the first year EUV entered mass production. Out the roughly €9 billion in net systems sales, EUV accounted for 31% of it or about €2.8 billion. The average EUV sits at €107.260 million (roughly $120 million). ASML shipped a total of 26 EUV machines in 2019, a major increase from the 18 machines shipped in 2018. By WikiChip’s analysis, the breakdown is 17 NXE:3400B machines and 9 NXE:3400C machines. Last quarter, ASML adjusted downwards the amount of EUV machines they expected to ship from twelve to eight. ASML did manage to deliver on the revised expectation of eight EUV machines. The four additional systems are now planned for early this year.

NXE:3400C Ramps, But So Does The Backlog

Last quarter ASML shipped its first three NXE:3400C machines. This quarter, by our analysis, ASML shipped six more machines. All in all, there are now nine NXE:3400C machines in the field along with 17 additional NXE:3400B machines that were also shipped last year.

There are a few important numbers to point out about ASML’s current production rate. First is that this quarter ASML managed to ship a total of eight EUV machines. This is the highest number of EUV systems shipped in a single quarter. This a good indication as foundries move deeper into EUV processes. This is also the first quarter where EUV was used for memory in addition to logic. Although memory uses significantly fewer layers than logic, they push out a lot of wafers.

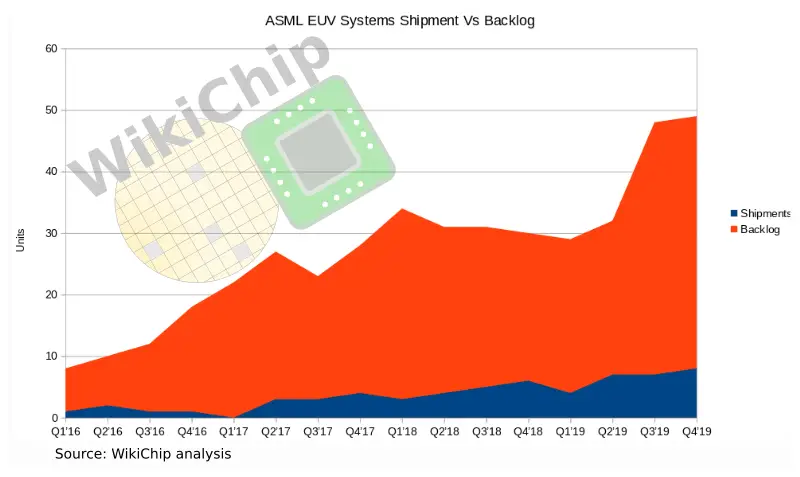

In our previous article, we have spotted a concerning trend with ASML’s EUV backlog. Despite shipping eight EUV machines in Q4, there were nine additional orders. By WikiChip’s own analysis, this puts them at 49 EUV machines orders. For 2020, ASML says it expects €4.5 billion in sales, a 60% increase from the €2.8 billion they saw in 2019. This number corresponds to 35 machines they plan on shipping. Note that this is 2 more machines than they expected last quarter which is good news. Last time we made the assumption that even if ASML manages to produce all those machines, at the current production rate, orders placed in Q4 won’t be fulfilled any earlier than mid-2021. Our analysis remains unchanged. New orders received this quarter won’t come until late 2021. It remains unclear what impact, if any, the large backlog in EUV machines will have on foundry roadmaps but it’s definitely something to watch closely. Note that in 2021 both TSMC N5P and Intel’s 7-nanometer nodes are expected to ramp. Both nodes are EUV-based and are roughly comparable.

To help with production, ASML says it is focusing on cycle-time reduction in their factories which they say will support the capacity of 45 to 50 systems in 2021. Historically ASML has been overly optimistic about the number of machines they can produce, but if they could ramp the number of machines into the low 40s, it would put a nice dent in this growing backlog.

ASML sees healthy logic demand to continue through 2020 due to HPC and the introduction of 5G. The memory market continues to be in a digestion period following a significant expansion from 2018. ASML says they see very early signs of recovery and this will translate to stronger demand in the second half of the year. This should translate to a sizable number of orders in the second half of the year.

Since EUV entered mass production in 2019, 2020 will be the first year where ASML will start recording significant income from service revenue for EUV. ASML Install Base Management enables foundries to upgrade their existing machines with some of the improvements ASML has made to their latest shipping systems. One of those improvements is to the availability. ASML expects to move closer to 90% availability with EUV in 2020 (by comparison, DUV machines operate at >98%). This is an area ASML continues to invest a lot of its R&D in. Moreover, the second half of 2020 is expected to be better than the first half. ASML expects 2020 to be a year of double-digit growth in both sales and profitability, driven by EUV and the installed base business.

Additional highlights:

High-NA – Current EUV machines are 0.33 NA. Next-generation of EUV machines, High-NA, will be 0.55. As part of ASML’s partial ownership of Zeiss, they plan on making major contributions to their CapEx with 50% of R&D being in high-NA. Return on that investment will happen when high-NA starts production (~middle of decade). When they enter production, high-NA machines are expected to provide over 50% reduction in cost versus EUV multi-patterning schemes and 3x to 6x cycle time reduction for critical layers.

DUV – Deep UV (DUV) continues to accounts for the lion share of ASML revenue and will remain important even as process nodes utilize a growing number of EUV layers. ASML sees a requirement for more innovation in the area of Deep UV and invests a large portion of its R&D budget for that. In 2019 this was about ~€2 billion.

–

Spotted an error? Help us fix it! Simply select the problematic text and press Ctrl+Enter to notify us.

–